Trusted by some of the biggest companies in the world

What’s New in the 2025 Tax Reforms?

The Nigerian government has introduced new tax updates, effective from January 2026.

Updated Tax Brackets

Employees with annual income of ₦800,000 or below are now exempt from personal income.

For Small Businesses

Businesses with turnover ≤ ₦100m and assets ≤ ₦250m exempt from CIT (Company Income Tax), CGT (Capital Gains Tax), and development levy.

For Large Businesses

CGT (Capital Gains Tax) now 30%, new 4% Development Levy applies, 15% minimum effective tax rate for large companies.

Updated VAT Rules

VAT stays at 7.5%. Healthcare and essential services now zero-rated.

SeamlessHR keeps you

fully compliant from Day One.

Payroll, tax calculations, disbursements, and employee data; all handled in one system.

Without SeamlessHR

- Manual tax calculations and updates

- Cross-checking spreadsheets and records

- Outsourcing for accuracy

- Frequent audits to avoid penalties

- Risk of non-compliance or missed deadlines

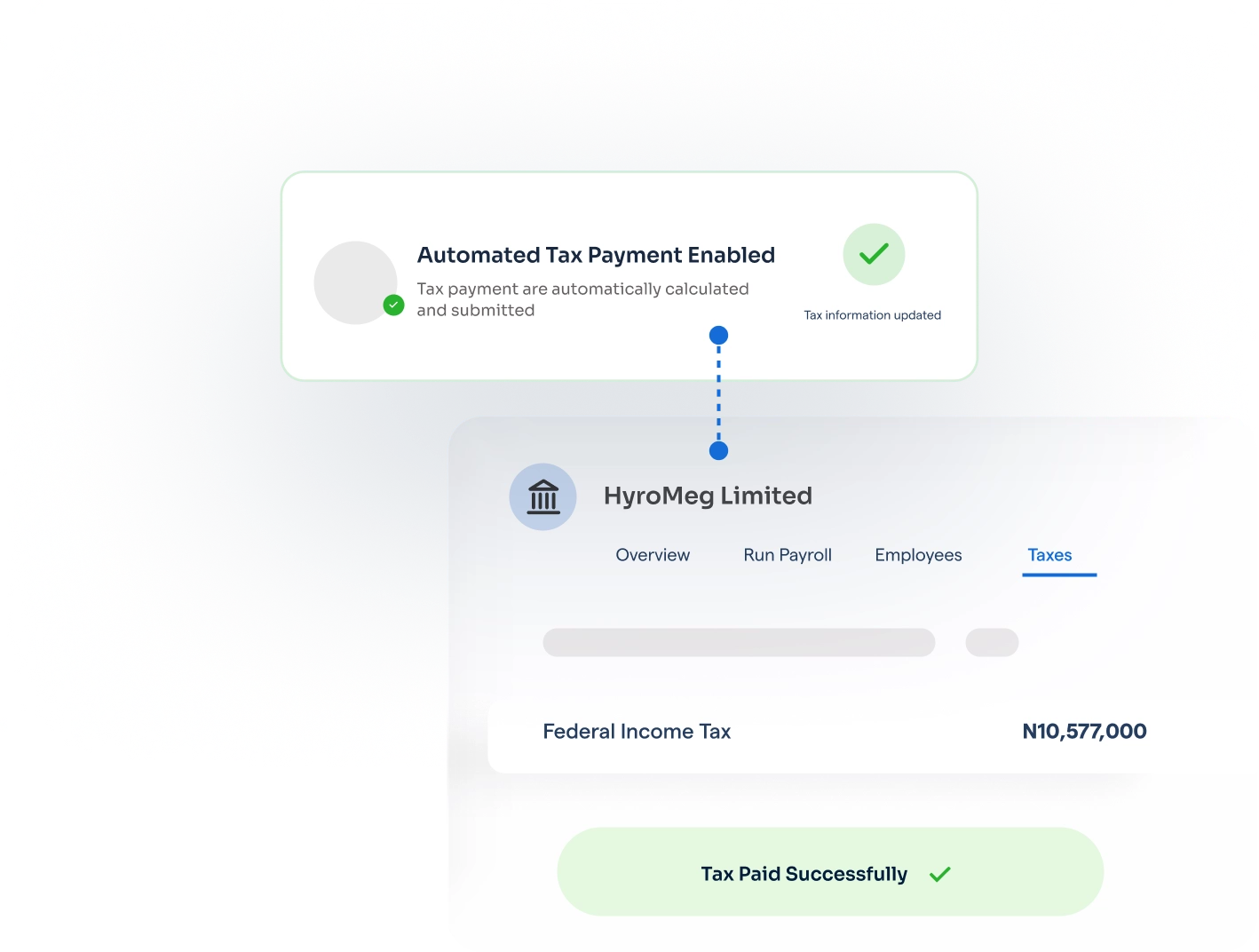

With SeamlessHR

- Activate Nigerian tax laws in one click

- Easy regulation-aligned tax calculations

- Accurate payroll calculations, allowances, deductions, and disbursements

- Real-time analytics and reporting

- Consolidated employee data across regions

- Reduced risk of errors and penalties

Fortress-Level Security

Protect your HR data with our ISO 27001 certified, GDPR-compliant platform. We offer enterprise-grade security, multi-factor authentication, and continuous monitoring for uncompromising security.

GDPR

Compliant

ISO 27001

resource playlist

Learn Everything You

Need to Stay Compliant.

Discover how businesses stay compliant with SeamlessHR.

One Software -

All your HR needs.