Kenya Payroll Guide: Calculations, Regulations & Payslips

Kenya’s growth, marked by projects like the Standard Gauge Railway (SGR) and a booming tech sector, reflects its Vision 2030 drive for innovation. With a projected growth rate of 5.2% from 2024 to 2026 and a 5.0% economic expansion in Q1 2024, driven by sectors such as agriculture and financial services, Kenya is becoming a […]

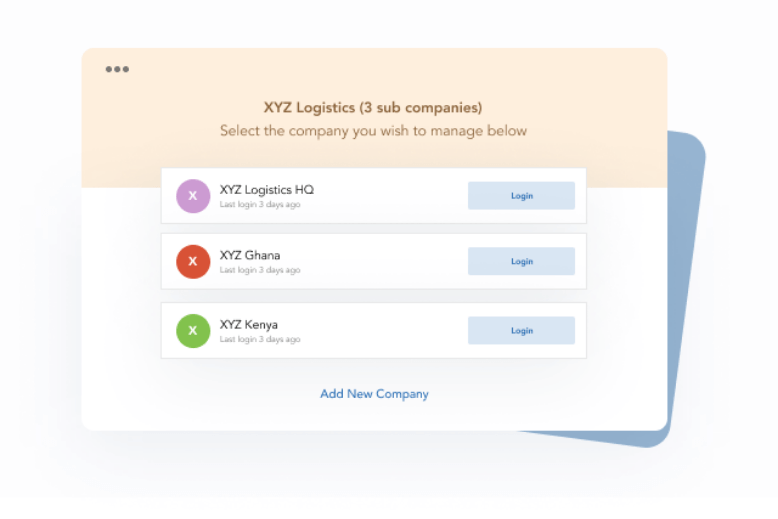

SeamlessPayroll is Taking Hitch Free Payroll Management Across the African Continent

SeamlessHR has launched its payroll management system, SeamlessPayroll in Ghana and Kenya! Last year, we announced a VC-led round of funding of an undisclosed seven-figure sum to be used in unlocking our next phase of growth. As we had stated, the plans for the financing were to optimize our product suite and drive pan-African expansion. […]